Financial Due Diligence & Business valuation

- Home

- Services

- Financial Due Diligence & Business valuation

Are you looking to grow your business?

Trusted us by over 3,000 local businesses

Financial Due Diligence & Business valuation Services In Sharjah, UAE

In today’s world, the very purpose of starting up and conducting a business is changing. Often businesses are started with a clear vision of attaining a higher valuation level and selling the business to relevant buyers.

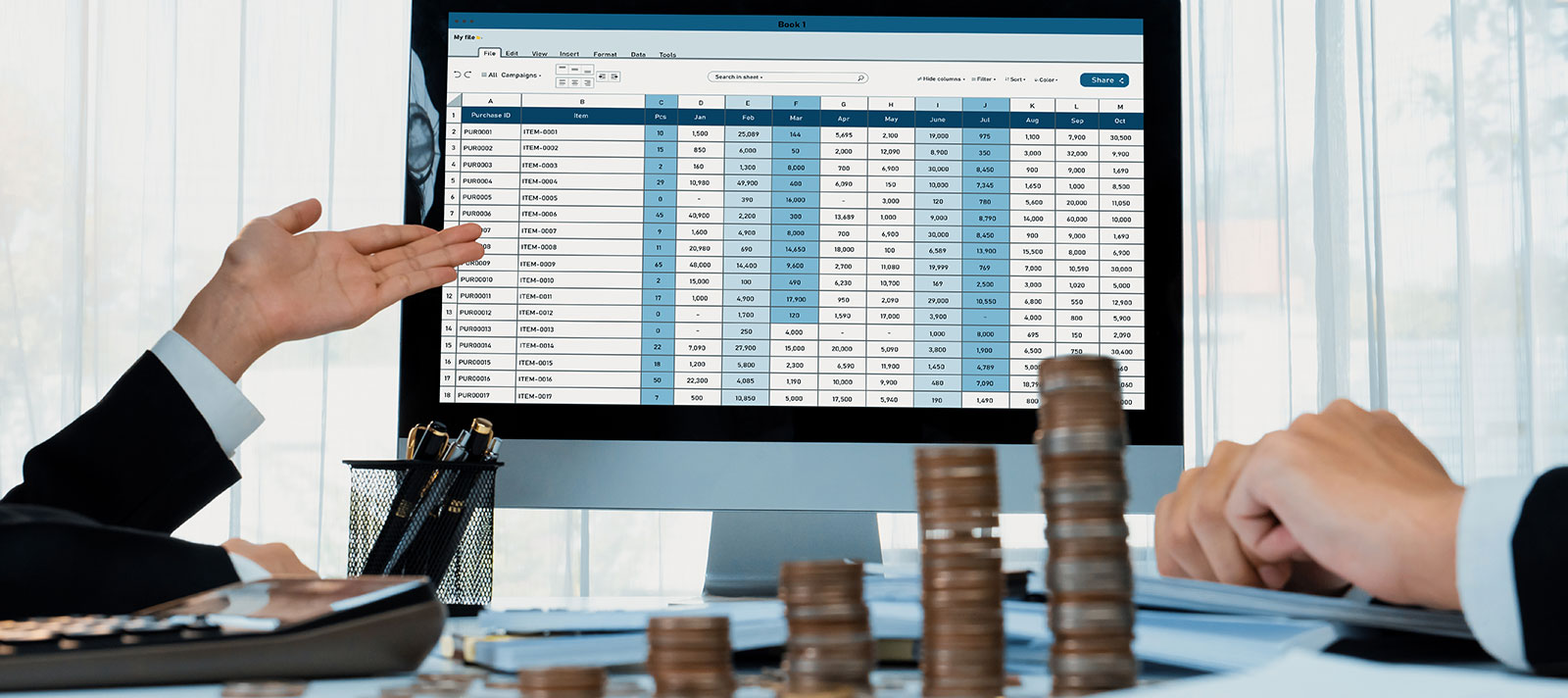

Financial Due Diligence & Business Valuation Services involve determining the economic value of a business, considering factors like assets, liabilities, income, management, and the location that the company holds. The necessity for business valuation arises in instances such as:

- Mergers & acquisitions

- Buy/sell a business.

- Selling shares in a business

- Insurance purposes

- Succession planning

- Shareholder & partnership buyouts/disputes

- Marital dissolution (divorce)

We have extensive industry experience in valuing businesses and shares. Depending on your specific need and the prevailing business environment, we adopt pertinent methodologies and a logical approach for valuation.

How can we help you?

Get in touch with Hussain Al Shemsi Chartered Accountants for expert auditing, accounting, tax, and advisory services in the UAE.

- +971 50 3636231